Back in pharmacy school, what Andrew Lam learned about a drug was never enough to satisfy his particular curiosity.

Lam’s professor would describe the characteristics of some drug – Lipitor, say – that it was used to treat cholesterol, that it shouldn’t be given to pregnant women or patients with active liver disease. Lam would be left wondering something like, but how did it get here?

“I got curious about how did it get to market to begin with, right?” Lam, now a venture capitalist, responded to a question about how he pivoted from pharmacy to investment banking. “You know: whose hands touched Lipitor before it gets to the market? How much of the economics do each of them get versus the pharmacist, and who gets the biggest chunk?

“You can go pretty far down the rabbit hole if you want, having these questions in your head,” Lam said. “And that’s kind of how I got interested.”

Lam spoke to a group of ACPHS faculty and students attending an Industry Insight webinar on March 16. The webinars, hosted by the Office of Institutional Advancement, feature ACPHS alumni and friends working in some aspect of the biopharmaceutical industry.

Many people see Lam’s current career in complete opposition to the one he contemplated in pharmacy school. Lam, however, sees that he is using his pharmacy expertise every day.

“On the face of it, it sounds like what I'm doing is not related to pharmacy, but I beg to differ,” he said. “I see (biotech investing) as a derivative of pharmacy, utilizing my Pharm.D. training as a drug expert. And the impact is potentially on a macro level.”

As a biotech venture capitalist with Ally Bridge Group, Lam helps choose emerging companies worthy of funding. He considers such issues as economics (the cost to produce the drug, for example), the market sentiment (is it an investible space), the company’s valuation and quality of the management, and – naturally – soundness of the science.

Lam did not immediately jump into the field after graduating from Long Island University’s Arnold and Marie Schwartz College of Pharmacy and Health Sciences in 2003. Following a fellowship, he worked for years as a medical science liaison, a position he recommended students consider, where he supported clinical trial enrollment, provide program and protocol training and served as a disease and product expert for biotech companies’ products. Wanting to make a bigger impact and see the big picture, he later transitioned to Wall Street, working long hours for several years, investing in his own on-the-job training as he developed a new skill set. He joined Ally Bridge Group two years ago.

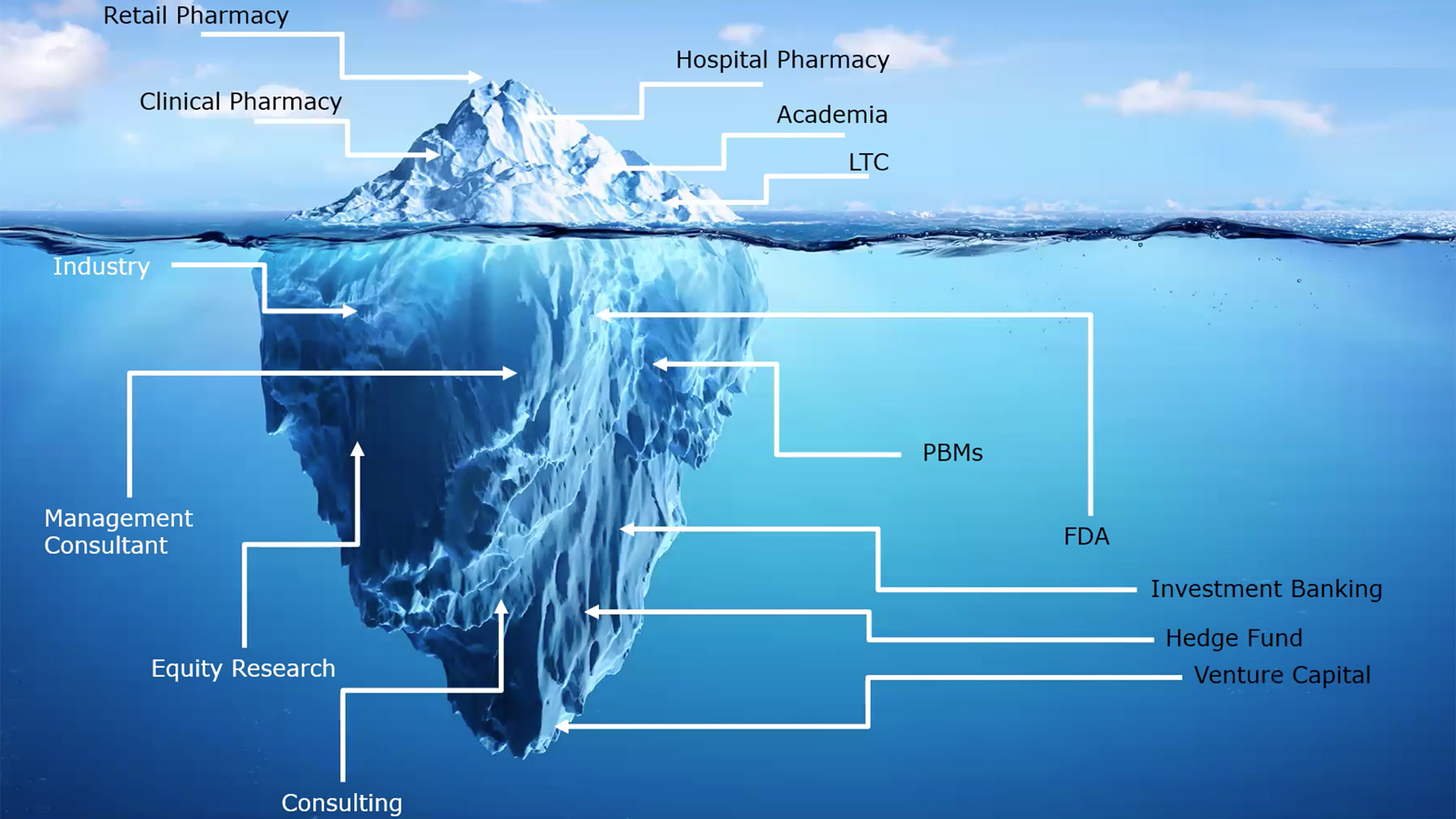

When he left pharmacy school 20 years ago, Lam said there were only a few career paths presented to him and his pharmacy classmates. They included working in retail, hospitals and other clinical settings, and academia. There were then and are now many others to follow, he told students, including various functions within industry, FDA, management consulting, of course, careers in corporate finance like investment banking or venture capital. (He illustrated this point with the iceberg graphic, above.)

He urged students to imagine their career paths using more of an internal compass than a GPS.

“You can’t really plan out your career too concretely because, first of all, you never really know what life has planned for you,” Lam said. “Your career is not GPS, meaning there are not turn-by-turn directions.

“It’s good to be ambitious, but also good to know these things take time, and a lot of it is just pure luck.”